ABOUT MÉXICO

Mexico is the 5th largest country in the Americas and the 14th largest in the world, with a total area of almost 2 million square kilometers.

Mexico has a privileged location as the heart of the Americas: geographically, it is part of North America, but its language, historical roots, and culture make it part of Latin America. In addition, its long coastline makes Mexico a natural bridge between the Atlantic and the Asia-Pacific region. The country is characterized by its wealth of natural resources, necessary for the productive development of any country.

Politically, Mexico is a representative, democratic, and federal republic with territory divided into 32 federal entities and 2,456 municipalities. Mexico has been popular with international investors for decades, and now Forbes has advised readers that this is an ideal time to invest in real estate in Mexico.

The secret is Mexico’s strong internal market, particularly the growing middle class. In 2018, it was estimated that the country’s middle class represented almost half of all households, at about 16 million. They are expected to continue to grow, with some 3.8 million more households expected to move into the middle class by 2030. Furthermore, most Mexicans who move generally prefer to buy rather than rent.

Some 82% of Mexicans want to buy a property, compared to 18% who prefer to rent, according to Lamudi’s recent 2018 Real Estate Market Report. External demand is also increasing again. US and Canadian buyers are returning to Mexico, after a multi-year slump, thanks to low oil prices and a strong US dollar pushing home values up. Mexico is also competitive in terms of real estate investment by a significant number of European countries (the Netherlands, Spain, Belgium, Germany, the United Kingdom, Luxembourg and Switzerland) and Asian countries (Japan).

The Mexican real estate market is not driven by speculators. There are a lot of developers, and it’s highly competitive. Due to subsidies, interest rates are (relatively) low in the social sectors. The demand for housing in Mexico is “real”, says Citibanamex Executive Director of Mortgage and Auto Credit, Ricardo García Conde, which means that movements in housing prices in Mexico are mainly due to supply and demand with a minimum percentage of speculative purchases.

The interesting thing is that, being a characteristic of the market due to its dynamism, it is a point of non-regression and now it is the rise of vertical housing and mixed developments become stellar in cities with a high growth rate such as Guadalajara, which has grown significantly in recent years, and other metropolises that, as a means of reusing space, build buildings in Mexico City, Monterrey and Jalisco, to preserve the perimeter of the urban area.

The residential market in Mexico involves many customer motivations that are part of the decision-making when buying or renting a property. It is a theme that is associated with the style and stages of life, as well as the purpose that is intended to be given to the space.

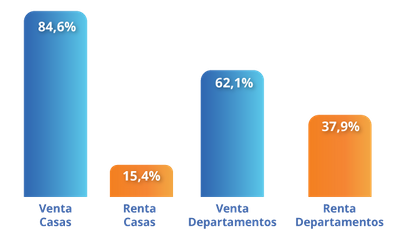

Regarding the residential market in Mexico, between houses and apartments, the figures show cumulatively that the participation dynamics have a proportion of 82% inclined towards sale, compared to 18% for rentals. Approaching the horizontal housing profile according to Lamudi, Mexicans show great interest in buying a house with a behavior of 86> 14 percent, and similarly, it is observed that the preference for choosing the department is more attached to the acquisition with 73% vs. Quotient. 27% rent.

If you have ever wondered, “Is buying a property in Mexico a good investment”, the short answer is a resounding “Yes!” In fact, owning a vacation home in a popular destination can provide incredible ROI and portfolio diversification, but first, you have to know where to look! By investing in real estate in Mexico, you’ll enjoy secure ongoing income that outperforms the stock market and also offers a number of exciting lifestyle benefits. Take a look at our top 10 reasons to invest in a vacation home in Mexico right now!

REASONS TO INVEST IN MÉXICO

Strength in the US dollar. Both the US and Canadian dollars have been at all-time highs against the Mexican peso, which equals fantastic bargains for investors, the same factor is true for the eurozone again the Mexican peso. From real estate investment to everyday expenses and cost of living, Mexico offers unbeatable value compared to other popular investment or vacation destinations around the world.

Cultural familiarity. Mexico is a close neighbor to the United States and Canada, sharing many cultural traditions and other similarities. From the food (and the mezcal- tequila!) to the shopping and activities, there is a bit of an American influence in Mexico, just as there is a lot of Mexican influence north of the border.

% – 10% Return on Investment. In hotspots such as commercial and tourist destinations, offering 7% – 10% ROI, which outperforms the stock market and also provides a hedge against inflation. As for other sectors like oil and gas 10-20%, some higher returns in real estate funds that are expanding in Mexico, especially in mixed real estate developments.

Easy access. The most popular places in Mexico also offer easy access to the main international airports, which offer many connecting flights to cities worldwide. This makes it easy to travel back and forth, which also makes it possible to achieve 80-90 percent annual occupancy rates in places like the Rivera Maya or business cities like Mexico City, Monterrey, and Guadalajara.

English-Local & Expats. You don’t speak Spanish? No problem! More than 1 million Americans now live in Mexico full or part-time, which is easily the largest expatriate population of any part of the world, and more than 1.6 million Canadians visit Mexico each year. Also, there are plenty of English-speaking locals, including professionals.

Property values will not depreciate. The real estate market in Mexico, Monterrey, Guadalajara, and Cancun is among the 10 fastest-growing real estate markets in the world and demand is easily outstripping supply.

Modern infrastructure. From high-speed internet and major highways to excellent medical facilities, international schools, and major brand-name businesses.

Quick residence and stays without a six-month visa. The process is quick and easy for both temporary and permanent residents. Another option is to get a six-month tourist visa instead, which is also easy to renew.

Mexico is one of the most competitive countries for productive investments in the world due to many factors, such as Competitive costs, a young and talented population, size and strength of its internal market, macroeconomic and political stability, economic growth, capacity to manufacture high-tech products, open economy that guarantees access to the most important markets in the world through a network of free trade agreements, according to the World Investment Report 2017 published by the United Nations Conference on Trade and Development (UNCTAD), in In 2016, Mexico ranked 16th as a recipient of foreign direct investment and 7th among developing economies. This report includes a survey applied to the main corporations worldwide that place Mexico as the ninth destination within their investment perspectives for the period 2017-2019.

Furthermore, foreign direct investment flows have had a favorable performance during the last 10 years, with a total amount of USD 330 billion in the period 2008-2018, destined mainly for the manufacturing, financial, mining, commercial, construction, real estate, tourism, media, professional services, and transport sectors.

CONSTRUCTION BEHAVIOUR IN MÉXICO

The Mexican Chamber of the Construction Industry (CMIC), through its report “Current situation and perspectives of the construction industry in MÉxico,” contracted growth in its productivity of 4% (GDP). “This behavior was the result of the growth observed in construction works (private works) and specialized construction works, with annual increases of 5.5% and 9.3%, respectively.”

Meanwhile, the vehicles that have been promoted to encourage investment and leverage currently register more than 6,429 Development Capital Certificates (CKD), 722 National Educational Infrastructure Certificates (CIEN), 633 Energy and Infrastructure Investment Trusts (FIBRA E), and 402 Investment Project Trust Certificates (CERPIS), an instrument created in 2016.

TRENDS IN CONSTRUCTION

Green buildings have the quality of greatly helping to counteract the effects of pollution, embracing the building in a peaceful environment, and are said to help regulate the temperature within the building. Although it is something that has already been seen over the years, kinetic architecture is gaining strength in the field of vertical housing, with mechanical or intelligent buildings regarding energy saving, expansion of the dimensions of space or its application to large metropolises.

As for the styles that are beginning to be seen more frequently in Mexico, the new trend called PopUp or passive construction comes from France and is characterized by being an armored house with the simple use of a screwdriver, it is easy to install and very fast, it uses recyclable materials (insulating blocks and wooden panels) and at a low cost.

THE BEST CITIES TO INVEST IN REAL ESTATE IN MÉXICO

Vertical housing

Mexico City, as well as Monterrey and Guadalajara, are considered in the list of the 100 most populated cities in the world. Vertical housing helps to distribute the population equally with an offer for all budgets that has a comprehensive vision that provides comfort to the resident or tenant by bringing it closer to their work areas and other activities.

Mixed uses

The three coverage areas of the Mexicans come together; housing, work, and recreation. They usually include offices, shopping centers, restaurants, supermarkets, departments, and gyms.

The hospitality

Hospitality is a fast-growing market, especially with the growth of the tourism and travel industry. The global travel and tourism industry continued to experience strong growth throughout 2020 and international tourist arrivals are projected to grow by 3-4 percent annually, reaching 1.8 billion by 2030, according to the UNWTO report. Its long-term outlook ‘Tourism Towards 2030’ envisions substantial potential for further growth from emerging economic destinations in Asia, Latin America, Central Euro and Eastern Europe, the Middle East, and Africa, growing at twice the rate (4.4% per year) than advanced economy destinations (2.2% per year). In the past, raising a hotel business required a huge capital investment, but in the last two decades, many hotel groups have expanded by adopting an asset-light management model, rather than owning properties.

The diversification of destinations in Mexico also indicates that there is significant growth in investment in hospitality.

According to Forbes, the most popular investment destinations in the country include Mexico City, Rivera Maya, Los Cabos, Cancun, Puerto Vallarta, and Rivera de Nayarit.

Mexico’s tourism industry is booming. The country is the Number 1 destination for tourists from the United States and is receiving record levels of visitors, which also enhances the discovery of new developments such as Oaxaca according to Forbes, Oaxaca Downtown and beaches continue to attract the attention of foreigners. See: The risks and rewards in the tourism sector in Mexico

Throughout my experience, talking about real estate in Mexico, particularly in the field of hospitality, has become a point of attention for passionate investors who demand creative projects and increasingly with an emphasis on disruptive real estate developments focused on lifestyles. This represents a perfect situation to link them with the existing real estate offer, currently, there is a diverse portfolio of real estate projects that offer multiple options to invest in beach destinations in Mexico, however, the great challenge is to find the ideal option with an excellent return on investment, innovative and that guarantees its permanence over time.

The real estate sector by definition is a capital-intensive asset with a long life cycle in terms of use and investment. Although it may become obsolete over time, but functional and operational, however, the introduction of differentiated models and new technologies can mitigate the impact of obsolescence, improving efficiency, flexibility, and residence, strengthening the value of assets hand in hand with the creation of projects that incorporate the concept of the community as its most important asset.

In our country, the price of housing has appreciated a little more than 9% in the first half of the year, according to the SHF Housing Price Index, the destinations above the national average are the banks of the Quintana Roo River, Puerto Vallarta, the banks of Nayarit, Mazatlán, Baja California and Yucatán. And although demand is what determines excess value if a destination becomes fashionable it tends to increase its prices because it offers the advantage of higher investment returns, it becomes more attractive and encourages those who are in the right place just before the real estate boom, which represents an opportunity not only for foreign investors with greater purchasing power, derived from the benefits of the exchange rate, but also for Mexicans who do not have income in dollars or another foreign currency.

Therefore, at this moment he is experiencing a true discovery on the beaches of Puerto Escondido in southern Mexico, in one of the states with the greatest cultural and racial representation in Mexico, where culture, art, and nature are part of the intrinsic identity of Oaxaca. In places like this it is common to hear people talk about the connection with the inner truth, the link with the origin; It is here where the proposals of the real estate chain focused on well-being in the “vamos” are appreciated, because more than a beautiful destination with magnificent beaches and exuberant jungles, Oaxaca offers a space to connect with others, it is like being human again.

More than a trending destination, this emerging rethinking of obsolescence is a differentiated behavior in which people are seen united as individuals, “me” and where they simultaneously become part of a larger-scale “we”.

WHY INVEST IN OAXACA?

Oaxaca is among the most important tourist destinations in Mexico and is today an important destination for foreign and local investors.

What makes Oaxaca an important place for real estate investments?

Oaxaca has 3 very important tourist destinations that register significant growth in real estate developments year after year due to the high demand for visitors. The city of Oaxaca registered 1,407,945 visitors in all of 2021, leaving a significant economic benefit of 2,826 million pesos.

The most popular places in the city of Oaxaca and nearby areas for tourists are Monte Albán, Mitla, Hierve El Agua, Barrio de Jalatlaco, Barrio Xochimilco, Santo Domingo, Zócalo, El Tule, La ruta del mezcal.

Another important destination in the state of Oaxaca is Huatulco, a destination with 9 bays and a significant growth in modern real estate developments that are mainly occupied by foreigners. Huatulco registered in the whole year 2021 a figure of 1,725,901 visitors with a significant economic benefit of 5,077 million pesos.

Finally, another favorite destination among young locals and foreigners is Puerto Escondido, a place with impressive beaches but a wild style due to the big waves that form on its main beaches.

Puerto Escondido received in the entire year 2021 about 1,072,192 visitors with an economic perception of 1,356 million pesos. Its main places to visit are Carrizalillo, Punta Zicatela, and Zicatela. Although there are nearby destinations such as Mazunte and Zipolite that are very popular.

Why should you invest in Oaxaca in real estate?

It is a tourist destination with an important economic flow throughout the year, the culture and tradition of the state is a very strong attraction for tourism that visits this land for long or short seasons, so satisfying their needs has become important real estate projects giving way to real estate gains.

GREAT REAL ESTATE AREAS WITH POTENTIAL TO INVEST IN OAXACA

Over the years, Oaxaca has shown significant economic development, which has been favored by its attractive tourist destinations, such as its beaches, its colonial city, a World Heritage Site, and its towns nestled in the mountains.

Oaxaca increased 49% in its real estate demand in the first four-month period of 2021 versus the first four-month period of 2020, occupying the 13th position nationwide in the ranking of the states with the highest growth in the demand for residential, commercial, industrial, office, and land for sale and rental properties. The real estate offer has a greater participation in the Residential sector with 47.7%, followed by Land with 37.6%, Commercial and Industrial have 9.1% and 3.2% respectively, and Corporate 2.4%.

Regarding the residential subsector, the offer in the state is divided as follows:

Municipalities with the highest demand :

Puerto Escondido as Huatulco, presents a high demand and growth of real estate projects. Due to its diversity, gastronomy, landscapes, climate, and exceptional culture, it is rich in real estate investment options.

With the upcoming opening of the Oaxaca Highway. Puerto Escondido, a great development opportunity will reach the entire coast of the State, thus implying a greater flow of national and foreign investment in different areas, with the real estate sector being one of the most benefited.

WHAT DOCUMENTS DO I NEED TO SELL MY PROPERTY IN OAXACA?

The documents you need to sell your property in Oaxaca are:

Public deed, owner’s ID, Public Registry, predial paid, Cadastral Certificate, Electricity, and water receipts. Freedom of Encumbrance, plans of the land or house.

WHAT DO I NEED TO BUY A PROPERTY IN OAXACA BEING A FOREIGNER?

The documents you need to buy a property in Oaxaca as a foreigner are:

1.- You must process the waiver agreement provided by Article 27 of the Constitution to acquire property outside the restricted zone.

2.- Through the creation of a Mexican company.

3.- Through a trust which is also useful in restricted areas.

WHAT IS A MEXICAN COMPANY?

Mexican corporations require a minimum of two associates or shareholders. Both shareholders can be foreigners, and it is not necessary to have a Mexican partner. There are several different types of Mexican Corporations, however the most common are the S.A. de C.V. and the S. de R.L. de C.V. The S.A. de C.V. is a stock corporation and S. de R.L. de C.V. resembles a limited liability company. Once the Mexican Company is constituted, the owner can acquire property anywhere in Mexico, including the restricted zone.

WHAT IS A TRUST FOR THE ACQUISITION OF REAL ESTATE IN MÉXICO?

A trust for the acquisition of real estate in México is a three-part contract whereby the seller (settlor) irrevocably transfers to a real estate bank (trustee) so that a third party (beneficiary) can use and enjoy such property.

WHAT IS ARTICLE 27° FOR THE ACQUISITION OF PROPERTIES IN MEXICO?

Pursuant to the provisions of section I of Article 27 of the Mexican Constitution, only Mexicans by birth or naturalization and Mexican companies may own land and obtain the concession for the exploration and exploitation of mines and waters in Mexican territory. The State may grant foreign persons the same right provided that they agree before the Ministry of Foreign Affairs to consider themselves as Mexican and to renounce invoking the protection of their Government, under penalty, in case of breaching the agreement, of losing the property they have acquired for the benefit of the Mexican Nation.

Likewise, it is reported that this procedure may also be submitted through the email articulo27@sre.gob.mx.

The DGAJ will answer your questions and inquiries by phone: 55 3686-5100, exts: 6419, 6407, 6441, 6126, 6416, 6430

WHAT ARE THE ZONES WITH THE HIGHEST DEMAND FOR ACQUIRING REAL ESTATE IN OAXACA CITY?

The zones with the highest demand for acquiring real estate in Oaxaca City are Downtown (centro), San Felipe del Agua, Tlalixtac, San Andrés Huayapam, Ejido Guadalupe y Etla.

WHAT IS THE RESTRICTED ZONE IN MEXICAN TERRITORY?

The restricted zone in Mexico refers to the land within 100 kilometers of any Mexican border and 50 kilometers from any coastline. In these areas, persons not born in Mexico may not purchase or have direct ownership of any land, unless they do so through a bank trust. Therefore, a trust is required for any non-Mexican residential property purchased in these zones.

AS A FOREIGNER CAN I OWN A MEXICAN CORPORATION?

Yes, as a foreigner you can incorporate a Mexican company, the incorporation of a company is an essential condition for a business to be considered formally established and to start operations, all in accordance with the legal provisions in force in the country. Get advice from the experts at www.silmexico.com or write to info@silmexico.com

WHAT IS AN ESCROW ACCOUNT AND WHY IS IT USED IN REAL ESTATE TRANSACTIONS?

It is a guaranteed deposit bank account that does not generate interest and allows you to support your money in an operation, this account protects the money and guarantees that the operation has a clear and legal process until the transfer of said money to the final account of the beneficiary.

As an example, if you are going to buy a property, you can guarantee the purchase by backing the money in the escrow account of the intermediary SILMÉXICO, who in turn will be in charge of reviewing the property documents (due diligence), signing a letter of intent between buyer and seller so that once the documentation operation is completed, the percentage will go to the beneficiary’s account.

WHAT ARE THE FUNCTIONS OF A NOTARY PUBLIC IN A REAL ESTATE PURCHASE-SALE PROCESS IN MÉXICO?

In a real estate purchase-sale process in México, the notary, through a public instrument, exercises his function independently of the public power and individuals, being in charge of interpreting, drafting, and giving legal form to documents such as a public deed.

DO I HAVE TO PAY TAXES FOR SELLING MY PROPERTY IN MÉXICO?

The answer is yes, it is necessary to pay the ISR (Income Tax) for the sale of real estate. The ISR for the sale of a house in 2023, is calculated based on the profit from the sale of the real estate, which can reach up to 35%.

It is possible to exempt the payment of ISR or deduct expenses that are subtracted from the profit from the sale. As long as the value of the sale does not exceed 700,000 Udis (Investment Units) or just over 4 million pesos. Payment can be avoided every three years.

WHAT IS THE ISR IN MÉXICO?

The Income Tax, or ISR, is a direct tax on the profits obtained during the fiscal year from activities such as the sale or rental of real estate, or the provision of some type of service.

It must be paid monthly to the Tax Administration Service (SAT) or, based on what is dictated by law and regulations in relation to Fiscal Coordination between the Federative Entities and the Federation, it can also be paid to the Offices Authorized by the Federative Entities.

WHAT ARE THE TAXES THAT SHOULD BE PAID WHEN BUYING A PROPERTY IN OAXACA?

The Real Estate Acquisition Tax (ISAI) also known as the Domain Transfer Tax, is applied in the purchase of any real estate property in Oaxaca. With it, the Treasury guarantees that the buyer is the owner of the property.

Likewise, other compromises the buyer shall assume are:

Rights for registration before the National Public Registry, and Notary Public fees.

- Is there any restriction to building in Mexican land as a foreigner?

There are restrictions for anyone who builds in Mexico, these restrictions are different depending on the area where you want to build.

WHAT IS PRIVATE PROPERTY IN MÉXICO?

Private property in México is when the Nation transfers ownership of land and water to individuals, constituting private property.

The property must have public deeds and a public registry in the name of the owner who, in turn, must comply with the obligations before the state, such as property and service payments.

WHAT IS A COMMUNAL OR EJIDAL PROPERTY?

Communal or ejidal property in México is when the Nation transfers ownership of land and water to the ejidos and communities, giving rise to social ownership, and reserves ownership and direct ownership of certain assets, which are part of public property.

An ejidal or communal property must have an act of possession and registration before the RAN in the name of the owner. Generally, this type of property is governed by the uses and customs of the community in which it is located, making the owner responsible for fulfilling the social responsibilities of the community as well as participating in the decisions of the place.

WHAT IS THE FREEDOM FROM LIEN OF A REAL ESTATE IN MEXICO?

The freedom from lien of a real estate in México is the certificate issued by the Public Registry of Property, which certifies that there is no obligation imposed on a property by credit or mortgage.

- What is a letter of intent in a property purchase-sale process and what is it used for?

The LOI (Letter of Intent) is a formal written agreement in which two parties guarantee an operation under certain terms such as price, property, and conditions.

This letter of intent links said agreement to the formal contract of the operation, the letter is used to offer and set aside a real estate.

WHAT IS THE ENVIRONMENTAL IMPACT MANIFESTATION IN MÉXICO WHEN BUILDING A NEW REAL ESTATE DEVELOPMENT?

The EIM is a tool of the environmental policy whose object is to prevent, decrease and restore the affectations on the environment, as well as the regulation of works or activities to avoid or reduce the negative effects on the natural environment and human health.

It consists of a technical and scientific study that indicates the effects a work or activity can generate on nature and points out the preventive measures that could minimize the adverse effects produced by the execution of developments. This study allows evaluation of environmental feasibility for the execution, manufacturing, commercial, or service investment projects.

It details the condition of the place before the start of the project to compare the impact or changes that occurred on the environment after the construction, and likewise, proposes strategies to reduce or prevent damage already caused or possible future alterations.

WHY IS IT IMPORTANT TO USE THE ESCROW ACCOUNT IN A PROPERTY PURCHASE-SALE PROCESS?

The Escrow account figure , in addition to being an impartial party in the operation of a sale, and not generating interest when using it, is essential for giving certainty to the parties involved, since this will act as the party that insures the deposit that is paid as an advance, which will eventually be released to the corresponding party once they have formally committed to carrying out the said operation, as well as compliance each of the requirements and conditions in the agreements established in the contracts that are entered into.

WHAT IS THE PROCESS TO BUY A PROPERTY IN OAXACA IF I AM A FOREIGNER?

First of all, you should identify in which part of the estate you will acquire the property, since not all the processes are the same, and they are attended individually, additionally to the time that takes to achieve the final target.

Talking about an acquisition out of the restricted area (it could be acquired through a trust or a Mexican corporation) in Mexican territory, the purchase can be carried out in a traditional way, as well as by a legal person. The process in SILMÉXICO is the following:

- LOI signing (Letter of Intent)

- Notice of purchase-sale to the Ministry of Foreign Affairs

- Security deposit to Escrow account.

- Signing of the purchase-sale contract

- Contract signing before notary public

- The LOI is the first document that is signed because the bases of the sales negotiation are established there, later:

- This is where the Escrow account comes in, granting that security of commitment to the parties in the operation to be able to advance, in parallel with the other requirements and processes, such as the due diligence process which must be fully complied with in order to proceed with the signing of the promise of a purchase-sale contract.

III. Subsequently, the purchase-sale promise contract is signed, making the transfer of property between the parties, the buyer and the seller, completely formal. SILMÉXICO’s recommendation is that the ratification of the purchase contract be carried out before a public notary with whom the official closing of the purchase is eventually carried out, in order not to generate uncertainty between the parties.

IV. The final step in this process; The parties involved go before a notary public to sign the sale of the property, generate a public deed for the purchaser and register it with the public property registry, as well as the documentation that emanates from the property, such as the identity cadastral card and the predial account of the property.

It is important to highlight that there are different processes and scenarios to acquire a property, such as buying through a trust a process in which SILMÉXICO is an expert, and of which we will be happy to help you do.

IS IT POSSIBLE TO BUY A COMMUNAL/EJIDAL PROPERTY AS BEING FOREIGNER?

It is possible as long as certain requirements that the community or ejido expose in order to carry out said acquisition are strictly complied with; the essential ones are those found in articles 13 and 14 of the Federal Agrarian Law of the United Mexican States.

You could opt for acquisition mediating a Mexican legal entity as long as the guidelines established in Article 126 of the Federal Agrarian Law of the United Mexican States are complied with.

WHICH BEACH OAXACAN DESTINATIONS GRANT BETTER INVESTMENT RETURNS?

The main places with the best optimal returns and investment results in Mexico are Huatulco and Puerto Escondido, it depends on who the project is developed with, which is why a team of experts in the field is needed, such as SILMÉXICO.

WHAT SHALL I KNOW IF I AM GOING TO ACQUIRE A PROPERTY IN PUERTO ESCONDIDO OR HUATULCO?

The main destinations more desired on the Coast of Oaxaca are without doubt Huatulco and Puerto Escondido, although both have paradisiacal beaches, a large occupation, and are relatively close to each other, this does not mean that the environment is the same, which is why the first thing you should know when wanting to invest in these places is what type of market is the one you intend to reach, in addition to:

1.- Puerto Escondido: Located approximately 100 kilometers from the Municipality of Huatulco, it could be said that the environment is similar to that of Huatulco, in vacation villages the number of tourists, mostly, are Mexicans or foreigners who visit the municipality for the attraction of its beautiful beaches, the atmosphere of merriment that exists in the bars of the area, and its always festive atmosphere.

2.- Huatulco: In addition to its 9 beautiful bays, what characterizes it is its calm and tranquility in the streets, intended for a market that seeks tranquility, away from the hustle and bustle of crowded places. Huatulco, despite its tourist impulse, continues to preserve the essence of always.

However, there are more places between these 2 beautiful destinations that are also very promising in growth, among them you can find popular places like Mazunte, Pochutla, and Puerto Angel, as well as other hidden but equally impressive places to choose the best option for you.

WHAT SHALL I KNOW IF I AM GOING TO ACQUIRE A PROPERTY IN OAXACA CITY AND ITS SURROUNDINGS?

When we think of Oaxaca, we imagine a place full of life, colors and customs, as well as the local people who embrace foreigners with their treatment and warmth. It is a strategic place to invest; Since, in addition to the fact that you can find properties within the Historic Center polygon, the surroundings of the city, such as Huayapam, San Felipe and Tlalixtac de Cabrera, have lately been in significant demand by developers and those looking to acquire some residential property. What is the reason? The views that can be seen from these points make customers fall in love with them, and because they are areas away from the hustle and bustle of the city, but close enough to amenities such as schools, supermarkets, hospitals, etc., they have become the perfect setting for a life in harmony.

WHY IS IT IMPORTANT TO HAVE AN ACCOUNTANT IN YOUR CORPORATION?

An accountant helps you to have a better order of the financial situation of your company and not only that, he also assists you in a precise way when it comes to expenses and income, as well as to be up to date with your tax obligations and also to have several fiscal strategies that favor the viability of the investment process of the project.

WHY IS IT IMPORTANT TO HAVE A CONSTRUCTOR IN A REAL ESTATE DEVELOPMENT?

Much is unknown about the work of a builder in real estate development, it is not simply building the structural and material part of what you want to do, it also involves looking for suppliers, the personnel that will participate in the construction; this in order to find the best possible scenario to execute the desired project in a perfect way.

WHY IS IT IMPORTANT TO HAVE AN ARCHITECT IN A REAL ESTATE DEVELOPMENT?

An architect must support the client not only with the architectural program, but also with the program based on their needs and thus find what suits them best. In addition to developing a plan in terms of construction and execution of work that adapts not only to the physical needs of the client but also to the environment.